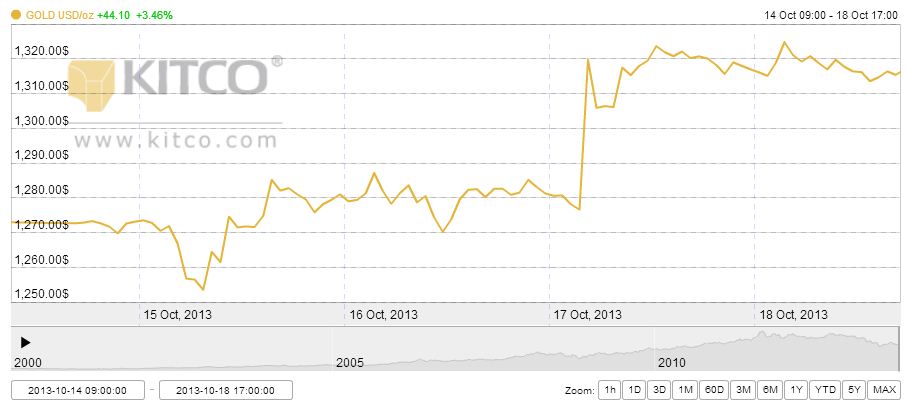

Monday Open: $1,272.70

Weekly High: $1,324.80

Weekly Low: $1,253.50

Friday Close: $1,315.40

The reopening of the U.S. government this week was, perhaps counter-intuitively, good for gold. The end of the partial shutdown on Wednesday supported gold prices, since traders can look forward to Congress revisiting the debt ceiling in a few months, meaning the U.S. economy is nowhere near recovered, and in fact will likely continue the Federal Reserve’s quantitative easing program until there is a more solid foundation underfoot.

Monday opened the week on a high note, rebounding from a drastic sell-off on Friday, which is now being touted by some analysts as market manipulation. The short rally on Monday kicked gold back up from a three-month low.

Tuesday lost some gains to short-term pullback yet gained some momentum because of anticipation of the debt ceiling cut off date, October 17. If the U.S. government would have been unable to reach an agreement about raising the debt ceiling, the country would have defaulted on some loans and had the credit rating downscored.

Luckily, Congress and the Senate were able to pass a budget by Wednesday night, effectively reopening government’s doors by Thursday. The effects of this decision on the price of gold hit full stride Thursday morning as traders rejoined the market. The thinking is that because the two parties still do not see eye to eye, there may be another incident like this in a few months, and the Fed will certainly not be raising interest rates in such an unstable climate. Also, because the government had been on hold for 16 days, no economic reports had been released in that time, so traders are awaiting the state of the economy. The dollar slipped and fell, as well, during all this talk of devaluation, another bullish factor for gold.

By Thursday, some of those gains were lost to short-term traders exiting the market. Friday followed suit and maintained a steady range into the weekend.

Leave a Reply