Monday Open: $1,317.60

Weekly High: $1,371.20

Weekly Low: $1,293.50

Friday Close: $1,325.50

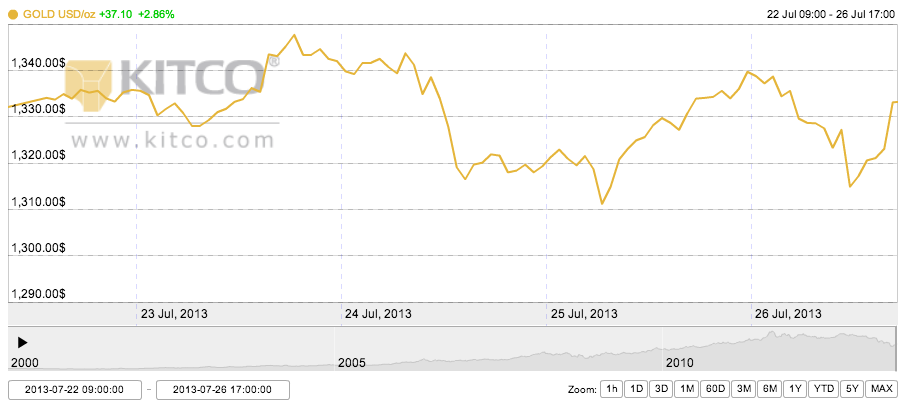

Gold prices responded to one major factor in the economic marketplace this week: the Federal Reserve announcing it will not start pulling back its loose monetary policy quite yet. The news was announced on Wednesday afternoon, to which the gold market responded by gaining 4.4% almost immediately. The rest of the American stock market responded positively as well, with the Dow Jones Industrial Average adding a quick 100 points during the feverish trading window.

The week started out low, however, with gold on the decline Monday and Tuesday, drawn down in response to some positive U.S. economic factors. The cost of living was reported to have risen less than expected, and the Consumer Price Index reported less-than-expected growth. Tuesday prices ended low on anticipation of the Fed’s address on Wednesday.

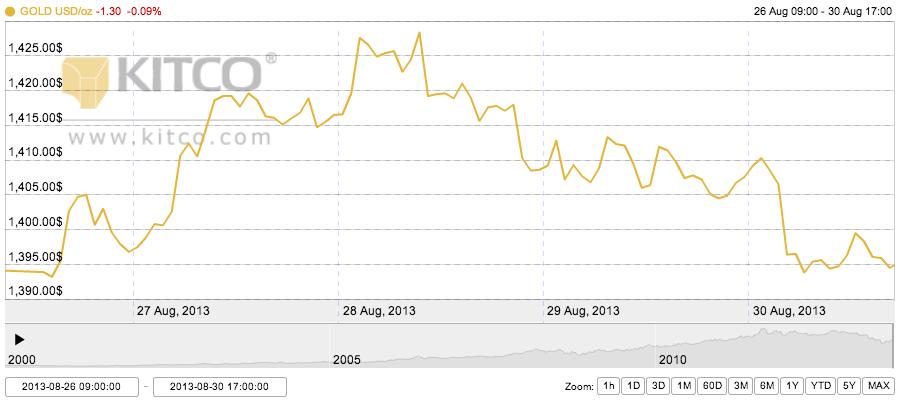

Wednesday’s spike bled into Thursday as traders were still digesting the news that the Fed will still continue to pour money into the market through their stimulus program. However, gold lost nearly all its gains from the week on Friday when St. Louis Fed President James Bullard made a statement saying that it could be as soon as October that the tapering program begins. Gold lost 2.8% to close the week slightly higher than it began.