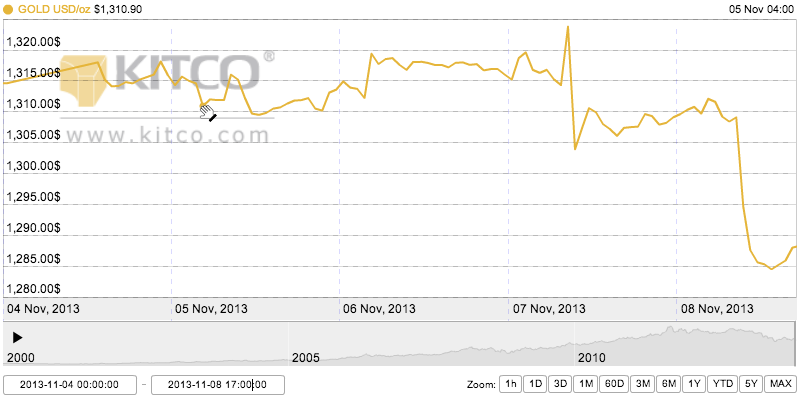

Monday Open: $1,314.60

Weekly High: $1,323.80

Weekly Low: $1,284.50

Friday Close: $1,288.80

Gold hit some bumps this week to close the trading day on Friday below the $1,300 mark. Monday began largely unchanged as two Fed officials gave strong indication that the bond tapering program would not begin until the economy has undergone significant improvement. (However, Friday’s economic reports caused this sentiment in the marketplace to become doubtful.)

Tuesday’s outside markets were bearish, with a higher dollar and lower crude oil. The low price of crude oil may indicate a hard time ahead for the commodities sector. Also on Tuesday, the ISM non-manufacturing report showed greater strength than expected, fueling some fear that the Fed may consider bond tapering sooner rather than later. China also reported more upbeat economic news, and leaders of the country are in conference about making economic reforms, which the market place will be anticipating in the near future.

The price of gold was bolstered slightly on Wednesday as the dollar sank and crude oil reached higher. The market place also anticipated the European Central Bank’s meeting on Thursday, as there were suspicions that the ECB will soon ease its monetary policy and lower interest rates.

Though analysts widely did not expect the ECB to make a move, they did in fact decide to lower interest rates on Thursday. Gold saw a short high after the news, since the deflationary measure increases the value of gold as a hedge fund against failing economies. However, despite the news from the ECB, the price of gold dropped to a three-week low on Thursday after surprisingly good U.S. economic reports.

Positive U.S. economic reports also racked the gold market place on Friday, continuing a downward trend. The U.S. employment report for October showed unexpected growth, with 204,000 new non-farm jobs, compared with the expected 120,000 increase. Gold responded poorly to this news, closing the week low, with increased anxiety that this news may prod the Fed to begin anti-deflationary measures soon.