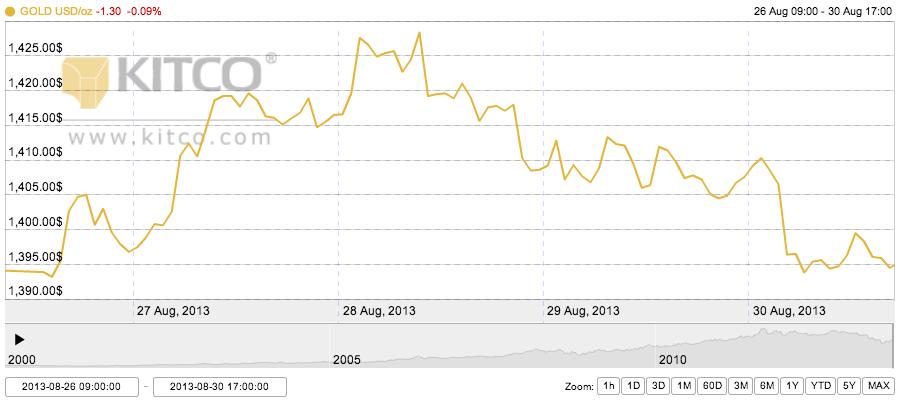

Monday Open: $1,393.90

Weekly High: $1,424.50

Weekly Low: $1,393.20

Friday Close: $1,394.50

This week’s gold price chart looks like a bell curve because mid-week spiked high in response to the Syrian crisis, then fell to close the week nearly as it started. Monday afternoon started the upward trend as gold broke the $1,400 price mark on safe haven trading related to the crisis in Syria. Secretary of State John Kerry released a statement that the U.S. believes Syria used chemical weapons against its citizens, a global war crime that President Obama said may be punished with a missile attack. George Gero, analyst at RBC, called the steady rising of gold prices in relation to the crisis, a “small fear premium.”

Tuesday continued the Syrian response trend to land gold a fresh three-month high, as the U.S. seemed poised to take military action in an already unstable Middle East.

Wednesday saw gold hit the week’s high, and also an all-time high against the Indian rupee. A faltering rupee could be bullish for gold, because even though gold is now more expensive to buy for those using the rupee, it reinforces the psychology behind why gold is important to have for the gold-savvy Indian consumers. Wednesday was a 3.5 month high for gold.

Thursday saw gold slipping back down from its mid-week high on profit-taking and a less nervous approach to Syria, after President Obama released a statement overnight that the U.S. does not plan on attacking Syria. U.S. allies are also not in agreement about what to do with Syria.

Friday’s extension of Thursday’s news continued to quell the anxiety over Syria, and so the marketplace responded by trading out of safe haven assets like gold, bringing the yellow metal back down to the week’s opening price range. The U.S. Labor Day weekend should mean that trading is slow throughout the beginning of the next week.

Leave a Reply