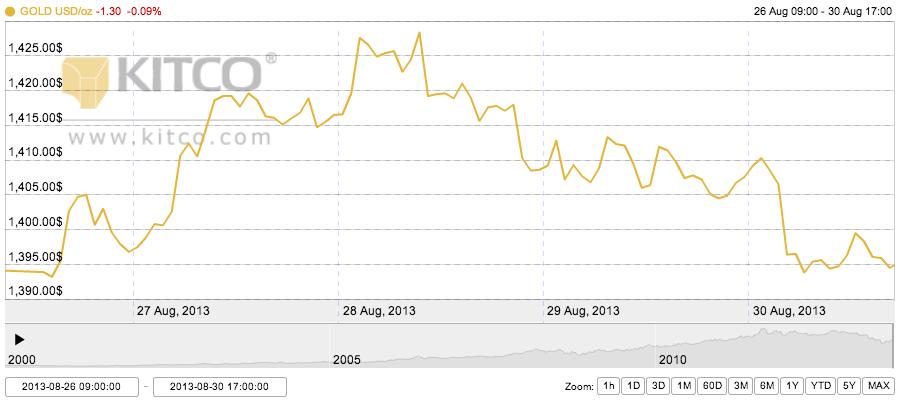

Monday Open: $1,389.90

Weekly High: $1,415.20

Weekly Low: $1,366.90

Friday Close: $1,389.20

Tensions in Syria continued to influence gold this week, and other global economic news also registered on gold’s radar.

Tensions in Syria continued to influence gold this week, and other global economic news also registered on gold’s radar.

Monday was a quiet day as U.S. traders stepped away from their computers for the Labor Day holiday. Overall, the yellow metal was little changed on the first day of the week.

Tuesday began the upward swing of the week, with traders returning to their desks to sweep up some of the lower gold prices for short-term trading. The continued question of a military strike on Syria was slightly revved up on Tuesday, as it seemed Congress might support President Obama’s plan to attack Syria for using chemical weapons. Traders returned to the gold market Tuesday on some increased safe haven buying.

Tensions eased slightly on Wednesday, causing some pullback from the stress trading. Prices also dipped on profit taking from the previous day’s wins. The U.S. Federal Reserve released an economic report Wednesday afternoon that showed the U.S. economy officially growing mildly to moderately, depending on sector. This news was not surprising, so it did little to affect market conditions.

Thursday morning was quiet on the gold trading front as traders anticipated a slew of U.S. economic data to be released in the afternoon. Sure enough, this data was positive and so caused a slump in the gold market. The reports included the weekly jobless claims report, the ADP national employment report, chain store sales trends, and more.

Even so, it was the U.S. jobs report Friday morning that people were anticipating, since many believe a positive report can influence the Fed to start their tapering program earlier rather than later. It was good news for gold bugs, however, with the unemployment rate falling one point to 7.3%, which was still behind expectations. The decrease was also not because people were getting new jobs but because people were leaving the work force, according to analysts. The non-farm payroll report was also lower than expected. Therefore, Friday afternoon saw prices rise to end the week near to where it began.

The Syrian conflict and the Federal Reserve’s decision about when to start the tapering program will likely influence gold prices next week.