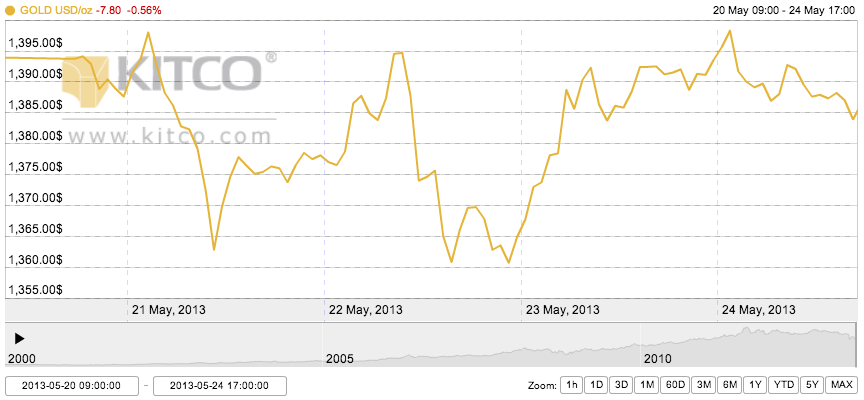

Monday Open: $1,394.50

Weekly High: $1,420.70

Weekly Low: $1,379.30

Friday Close: $1,385.50

The price of gold posted its 7th monthly decline in 8 months this week. Gold has always been volatile, but it seems as if this losing streak isn’t going to skyrocket upwards anytime soon.

Monday was a fairly complacent day, but Tuesday experienced some losses against the strong U.S. dollar. However, the losses were minimal for gold as compared with the relatively high place of the greenback, which is a good sign for gold.

Wednesday saw the yellow metal make some gains as the dollar dropped. U.S. Treasury bonds are rising in price this week, hitting the highest in a year, which is a sign of a recovering economy and increased likelihood that the Federal Reserve will soon start to change its loose monetary policy, a prospect that has been on the gold horizon for many months now.

Thursday saw gold continue its upward climb as Asian stock markets declined and sent some people back to the safe haven of gold. Thursday marked a fresh 2-week high for gold, but declined again on Friday on a technical correction. European stock markets reported high unemployment, the U.S. dollar index was firm, and the market place awaited economic data from China on Saturday. Also, the wedding season in India is now over, reducing demand for physical gold.