Monday Open: $1,654.50

Weekly High: $1,681.90

Weekly Low: $1,654.50

Friday Close: $1,667.90

It was a good week for gold after many U.S. economic reports and the Federal Reserve’s regular meeting concurred that the U.S. economy is not yet in a state of repair strong enough to push down gold. Following a bearish decline from last week, this week closed on a higher note than it opened.

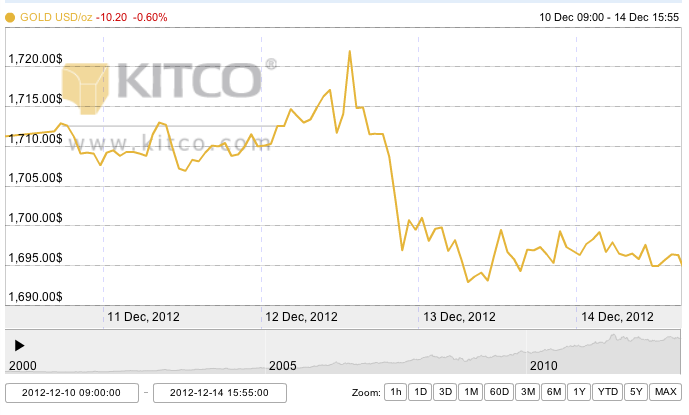

Monday started off sluggish, a little flat on a relatively strong dollar. Most of Monday was spent in anticipation of news to come later in the week. Tuesday rallied a little bit as the dollar sunk slightly, and a Consumer Confidence report revealed worse than expected economic data – a 58.6 rating, well below the 64.0 expected mark.

Wednesday was the real day of growth for gold this week. The price of gold was bolstered by the Federal Reserve’s FOMC meeting, in which Chairman Ben Bernanke reiterated the low interest rates and bond-buying program that was set in motion at the end of last year. Concerns have arisen lately that the Fed might pull back on their quantitative easing should the economy show considerable improvement, but the U.S. GDP report released this week showed that the country’s economy had actually contracted 0.1% in the fourth quarter of 2012. Bernanke confirmed that interest rates would remain negligible until unemployment hits 6.5%.

Unfortunately for gold, the yellow metal gave back all its gains on Thursday, despite bullish factors in the marketplace like a weak dollar and poor economic data. Though no one single external factor can be pinpointed for this loss, the drop was probably due to profit-taking from short-term traders.

Friday saw a continued release of negative U.S. economic data, which gave a small spike to the price of gold. The U.S. jobless claims report missed their mark by 38,000, ticking the unemployment rate up to 7.9%. However, later in the day a stronger manufacturing report was released, undoing many of the slight gains that had occurred earlier in the day.

Next week, gold is predicted to stay in the $1,650 to $1,700 range, with the European Central Bank meeting on traders’ radar.