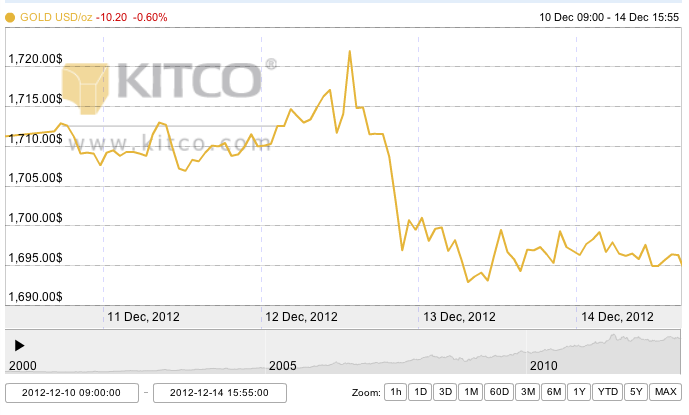

Monday Open: $1,690.00

Weekly High: $1,695.40

Weekly Low: $1,657.40

Friday Close: $1,659.20

Though lacking significant external selling pressures this week, gold nonetheless took a $30 loss to break the upward trend that was characteristic of the beginning of the year. The price drop can be generally attributed to global economic improvements that are projected to continue throughout 2013, lessening interest in gold as a safe haven.

Monday opened slow and steady as trading was quiet for the Martin Luther King, Jr. holiday. Tuesday was also fairly steady, despite bullish news for gold from Japan. The Bank of Japan announced a quantitative easing program that would raise its inflation aim from 1% to 2%. Amidst this news, the U.S. dollar fell against the yen by 1.2%, but this didn’t make much impact on gold.

Wednesday’s global economic reports caused a drop in gold. The European Union reported positive growth for January, and a Reuters poll projects overall world economic growth based on a recovering Asian economy. With major industrialized countries showing economic recovery, gold hasn’t necessarily lost its sheen, but it may be downplayed as a safe haven investment in the coming weeks. Citibank downgraded its projection for gold on Monday by 4.2% to $1,653 per ounce for 2014.

Thursday dropped gold back to a mid-December trading range, 13% below the highest the yellow metal ever reached in 2011 – $1,923 per ounce. Thursday’s decline may just be a continuation of the previous days positive global economic growth reports. Friday continued to descend to end the week with a two-week low.

However, all expectations for gold are not lost; they seem to just be paused. While most analysts expect to see slow movement for gold in the next few weeks, ScotiaMocatta, a global trading company, highlights the big picture by saying in a report, “The financial system is drowning in debt and there seems no end in sight to ongoing massive budget deficits. Confidence in the financial system and in the fiat government paper that facilitates it will remain low.” Next week, the FOMC will meet again, but no monetary policy change is expected.