Monday Open: $1,675.20

Weekly High: $1,689.50

Weekly Low: $1,628.00

Friday Close: $1,651.70

Gold ended 2012 with a 12 year hot streak. The past decade has treated gold very well, and this yellow metal has been the talk of the town amid a global recession. Seen by investors as a safe haven, gobbled up by governments as alternative currency and watched by many as an indicator of economic turmoil, gold has had a large role in global finances in the past ten years. Although gold closed this year nearly $300 below the all-time high of $1,900 from 2011, the price of gold is still at a remarkable high, and boasts a 6% increase from the price at the end of 2011.

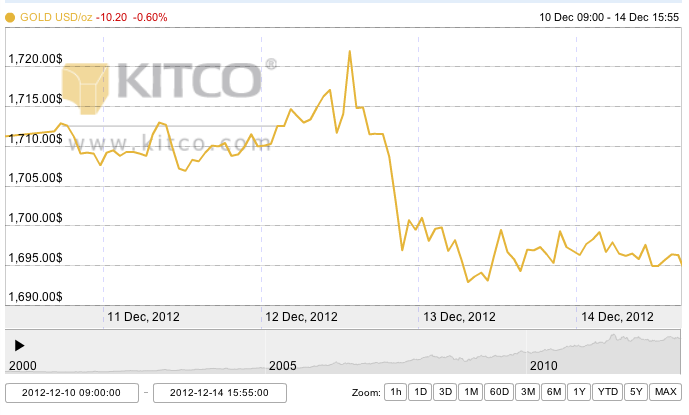

The markets were silent Monday and Tuesday for the New Year holiday, but reopened with a bang on Wednesday. Starting the year off right, gold responded well to the announcement on Monday that U.S. policymakers had reached an agreement regarding the fiscal cliff. Wednesday saw this week’s high of around $1,690. The fiscal cliff agreement, which had worried investors and citizens alike, rallied a global spike in trading around the globe.

Thursday, however, gold started to dip after better-than-expected unemployment data for the U.S. was released. A firmer dollar also slipped gold down a little, as these factors lessen the strength of gold as a safe haven investment.

Friday also saw losses in the gold market as investors worriedly responded to the previous day’s Federal Reserve meeting, in which members expressed mixed ideas about keeping the loose monetary policy that had been in place all of 2012. After the prolonged fiscal cliff agreement (a decision wasn’t reached until after December 31st, the cutoff date) Federal Reserve members discussed shortening the length of time for the previously decided mortgage-backed securities and long-term Treasury bonds. Some believe the policies should last until the end of 2013, some think they should end before the year, and some think there even needs to be further measures implemented.

These loose monetary agreements keep interest rates low, which at once help the economy bolster back but also create conditions rife for inflation, a positive sign for the hedge fund gold. With stricter Fed policies, gold may not be seen as such a secure hedge fund. Friday saw prices drop to the lowest since August. Gold investors will be keeping a very close eye on the Fed’s moves.