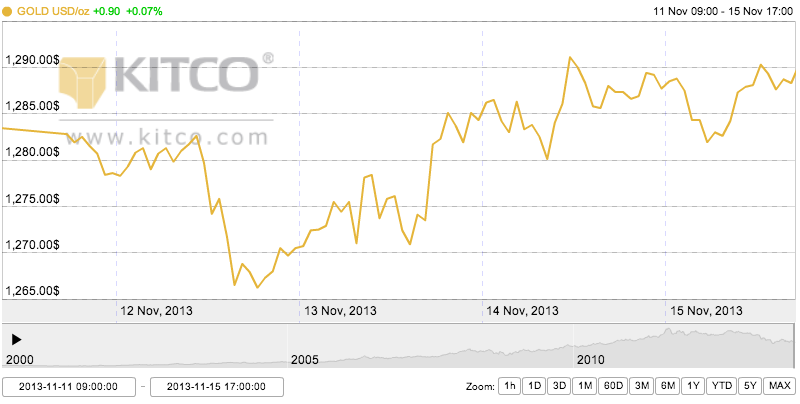

Monday Open: $1,282.80

Weekly High: $1,286.10

Weekly Low: $1,266.20

Friday Close: $1,288.30

The week opened slow on a holiday (Armistice in Europe and Veteran’s Day in the U.S.), yet gold prices still took a nosedive overnight before the beginning of the week, after better-than-expected employment reports from the previous week.

Tuesday hit a four-week low on selling pressure. With improved economic reports in the U.S. comes heightened anxiety in the market place that the Fed will soon resume its talk of bond tapering. Asian demand for gold has also decreased, and the U.S. dollar has been strong for about two months now, an overall bearish factor for gold.

Wednesday closed on a new four-week low. Without any major world or economic news, the market is moving solely on technical selling and continued fears about the Federal Reserve. Some analysts have predicted that quantitative easing could start upon its end as soon as December, while others expect it for the beginning of the first quarter of next year. These predictions have moved nearer in time recently, with the strong economic data from the U.S. encouraging people to believe the time is soon. The real defining factor will be how long economic improvement can remain steady.

Thursday experienced a short rally after Janet Yellen, next Federal Reserve chairwoman, released remarks that U.S. monetary policy needs to remain accommodative so that unemployment can continue to decline and the economy can continue to improve. Her support of monetary stimulus is bullish for gold. Friday’s gold prices remained relatively unchanged as the yellow metal headed into the weekend with traders divided on the outlooks for gold.