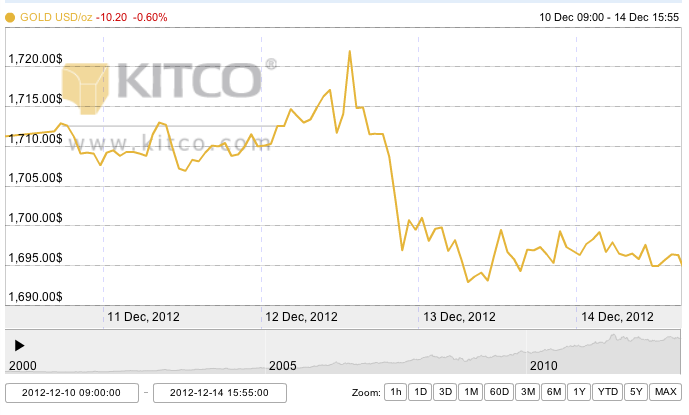

Monday Open: $1,711.90

Weekly High: $1,722.00

Weekly Low: $1,692.90

Friday Close: $1,696.30

The big news in gold trading this week was the two-day FOMC conference, economic reports for major world economies, and an automatic trading sell-off in Asian trading. The FOMC conference spiked prices on Wednesday, then sell-off sprees dropped the price for almost no reason on Thursday. Speculation abounds about whether gold has reached its limit as we head into 2013.

Monday was relatively quiet, and not much trading occurred after President Obama and House Speaker Boehner met face to face on Sunday to discuss the fiscal cliff crisis. Traders in all sectors are worried what will or won’t happen before the end of the year, and the fiscal cliff still tends to bring all commodities sectors down, but nothing new brought any light to the situation. The OECD released a report that projected that economies of the U.S., the U.K and China will grow over 2013, but that those of the European Union, Japan and Canada are expected to contract. If world economies are bouncing back, this could be a bearish factor for gold.

Yet, gold responded positively to the news from Tuesday and Wednesday’s FOMC meetings that the Federal Reserve plans to keep interest rates low for approximately the next three years, or until unemployment reaches 6.5%. The meeting discussed the end of “Operation Twist,” and the beginning of a new bond-buying program, which will entail buying $45 billion of Treasury bonds. The price of gold rose almost $9 on Wednesday.

Yet, Thursday saw some unexpected drops from that high, as Asian trading enacted some automatic sell-stops, which forces selling once a price reaches a certain point. This same trend happened a few weeks ago, for no logical reason, adding an unpredictable factor to gold trading.

The European Union, meanwhile, reached an agreement to appoint a single bank supervisor and EU banking union, which will be a positive sign for their economic recovery. Friday stayed at the low end of the sell-off range to close the week slightly below $1,700.

Gold is undoubtedly a volatile investment at this point in time, and some predict bearish futures for gold, citing that the precious metal is nearing the end of its decade-long streak, but others retain that with the world’s biggest economies still in flux and in the midst of inflation, gold is still a safe hedge fund. Goldman Sachs predicted the end of the gold, while Morgan Stanley credited gold as the “best commodity for 2013.”

Leave a Reply