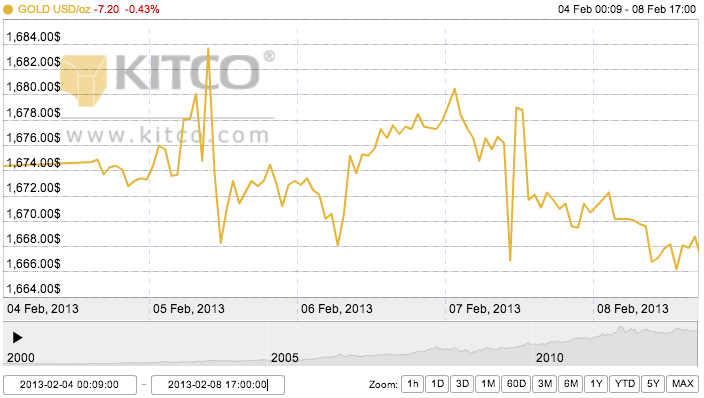

Monday Open: $1,674.40

Weekly High: $1,683.70

Weekly Low: $1,666.90

Friday Close: $1,668.80

It was a very choppy week for gold that ended on a slightly lower note than it opened. Rife with economic news from China, the U.S. and the European Central Bank, gold did some flips this week and continued its streak of general volatility.

Monday was the quietest day of the week, with just a few outside factors sparking a bearish lull, including a higher dollar and lower crude oil.

Tuesday’s price shot straight up midday on news from China that their new gold flow into the country had risen 47% in 2012 to an all-time high. Central banks across the world have been buying gold for their reserves, so China’s continuation of this trend was a positive sign for the general price of gold. However, the price shot straight down again after positive economic news from the U.S. and the euro zone economy. The euro zone showed stability and growth in January, the best in 10 months, and a fiscal report was released from the U.S. that predicts the national budget to drop to $845 billion in 2013, a major shift from the trend of trillions-plus. These were both signs to gold investors to move into the equity market, causing a price shift downward.

Wednesday showed slight gains on technical trading and short covering, but it was also a fairly uneventful day as traders awaited the outcome of Thursday’s European Central Bank meeting.

Thursday proved as choppy as Tuesday, starting in the morning with Mario Draghi, ECB president, speaking on the improved state of the European economy, though still hinting at reservations for the euro. This sunk the euro, pushing gold up. Then, however, U.S. jobless claims reports came in and showed significant improvement in unemployment, the claims report falling 5,000 short of expectations. Gold dropped. Yet, the price of gold didn’t stay down long as bargain hunters entered the market to buy up stocks at the lower price.

Gold ended slightly lower on Friday on a higher dollar and a rise in U.S. equities.