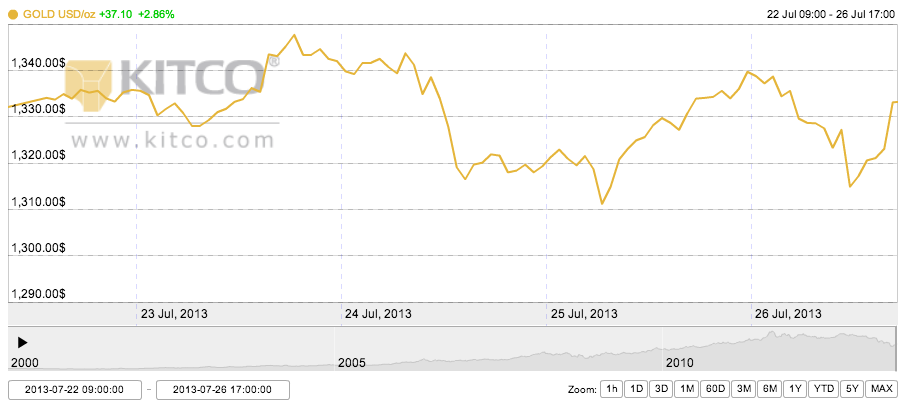

Monday Open: $1,302.30

Weekly High: $1,314.70

Weekly Low: $1,275.10

Friday Close: $1,313.20

Summer trading was fairly quiet for gold this week. Monday closed the first day of the week on a slight downturn, due to lack of fresh bullish news for precious metals. In related news, China’s economy reported growth on Monday, which could be bullish for gold in the long term, since China is the world’s second biggest buyer of the yellow metal.

Tuesday featured “Fedspeak” by Atlanta Fed president Dennis Lockheart, which also brought the market down. Lockheart made the statement that he expects the tapering program to begin by the end of the year. Tuesday’s gold market responded negatively to this statement, dropping gold to below the $1,300 mark to hit a new three-week low.

Wednesday recovered some of those losses in short covering after midday selling pressure had worn off. Overall, trading is still relatively quiet and uneventful during these “dog days” of summer, when traders in North America and Europe are vacationing and away from their computers.

Thursday was the best of the week for gold, shooting up above the $1,300 bar to overcome previous losses. The dollar contributed to this gain by hitting a six-week low overnight, and the European Union also released news that the economy was improving, a bullish factor for many markets.

Friday ended the week by consolidating the gains from Thursday to end on an overall higher note.