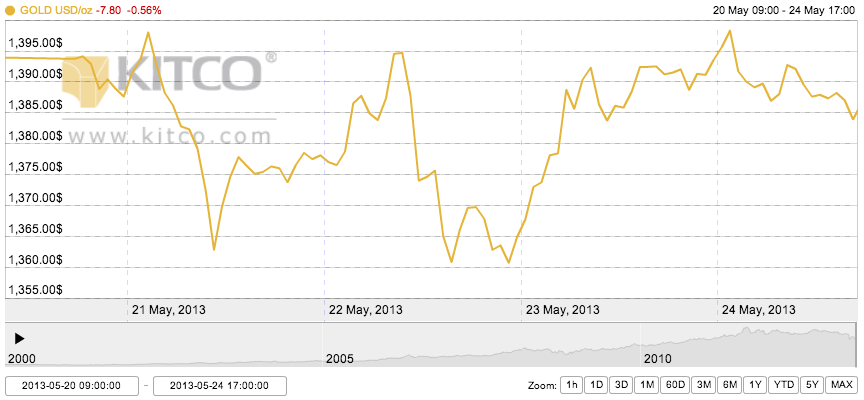

Monday Open: $1,393.70

Weekly High: $1,398.30

Weekly Low: $1,360.70

Friday Close: $1,383.90

Still prevalent on gold investors’ radar is how the Federal Reserve may be scaling back their quantitative easing program. This concern factored heavily into the ups and downs of the yellow metal this week.

Still prevalent on gold investors’ radar is how the Federal Reserve may be scaling back their quantitative easing program. This concern factored heavily into the ups and downs of the yellow metal this week.

Monday opened fairly higher to correct the seven-day loss streak from the previous week. Midday Moody’s announced that if the U.S. could not correct its budget and deficit problems by the end of 2013, the credit rating agency may downgrade its credit rating. Gold sparked higher at about this time.

Tuesday saw gold move up past its initial morning low after Federal Reserve at St. Louis President James Bullard announced his recommendation that the FOMC should not completely cut its bond-buying program and instead scale it back if need be. There have been indications from the Federal Reserve that this year may be the end of its quantitative easing (QE3) program, which would be dramatically bearish for gold.

Fed Chairman Ben Bernanke made an announcement on this point on Wednesday, perhaps confusedly remarking to both sides. He stated that he was still fully in favor of the QE3 program, but later answered a question to the effect that the next few months may see a tapering of policies. The gold market responded more strongly to the latter statement, dropping down to the week’s low.

With the low price from Wednesday, Thursday saw traders selling off in risk aversion, as well as a resurgence of safe haven buying. Friday trading was quiet, perhaps in anticipation of the U.S. Memorial Day weekend.