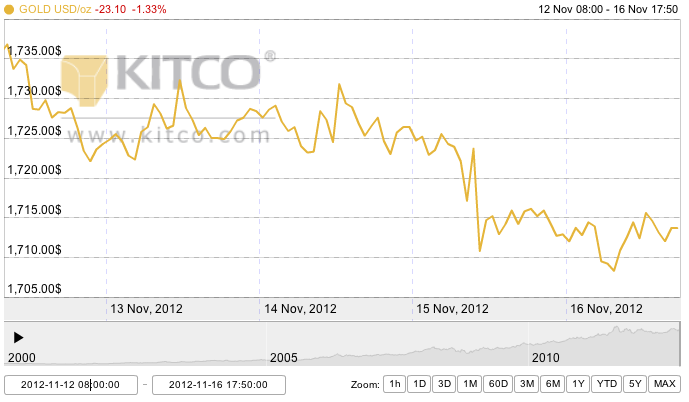

Monday Open: $1,717.20

Weekly High: $1,717.20

Weekly Low: $1,686.30

Friday Close: $1,702.80

It seems like the only thing gold investors could talk about this week was the upcoming fiscal cliff, a threat that sunk the price of gold to its lowest in four weeks, plunging the price down below $1,700. The price of gold stayed low all week but managed to dip up slightly about the $1,700 mark on Friday.

Negotiations about the fiscal cliff continued this week, but Democrats and Republicans are still undecided about how to approach the looming crisis. If an agreement is not reached by Jan. 1, automatic tax increases and spending cuts from the Bush era will go into effect. Economists believe this might send the U.S. back into a recession. Though it seems likely that politicians will indeed reach some sort of last-minute conclusion to avoid a recession, the uncertainty surrounding the matter is a drain on many markets, gold not excepted.

Monday dropped about $15, then Tuesday took a net drop of around $20, next to hit Wednesday’s low of around $1,685 – the lowest in a month. Thursday stayed fairly flat.

This week was primarily led by economic speculation as to the U.S. government’s policies regarding the fiscal cliff, but investors also looked forward to Friday when the Labor Department would release employment data for November. And indeed, Friday moved prices up a little bit.

December 10-12th is also a series of days to look forward to for gold traders, as it is the FOMC’s next annual open market meeting, in which they will discuss QE3 policies. After this past September when the Fed eased up on monetary policy, to the delight of precious metals investors, many expect that they will continue to enact policies to boost the economy, which in turn will bolster gold as a safe haven. “Operation Twist” will come to an end, a program in which the Fed sells $45 billion of short-term treasuries each month in order to buy long-term treasuries. Most do not think the Fed will continue Operation Twist, instead most likely opting to engage in a conventional bond-buying program, which would increase money-printing, inflation, and thus the confidence in gold.

Goldman Sachs predicts that the slow U.S. economic growth will force the Fed to keep printing more money for the next two years, a positive sign for gold.

Considering the volatility that gold is facing right now, some are questioning the reality of the yellow metal as a true safe haven. Still, in a Kitco survey, out of 24 respondents, 15 see prices moving up next week and 5 see prices going down, with the rest neutral.