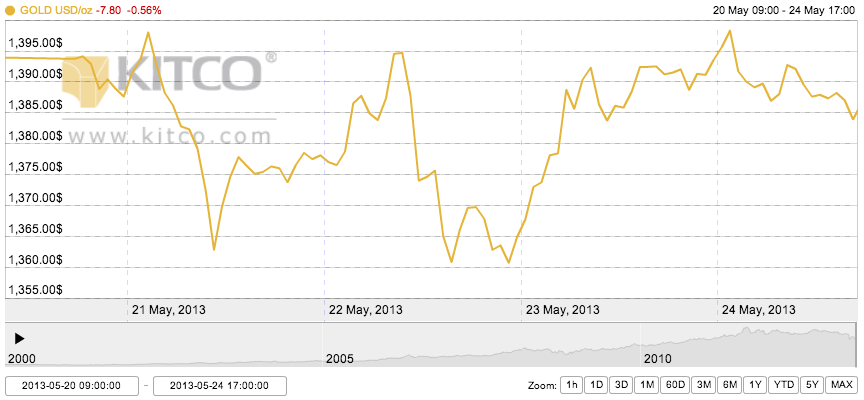

Monday Open: $1,385.10

Weekly High: $1,394.50

Weekly Low: $1,368.10

Friday Close: $1,390.60

The price of gold was characterized this week by fluctuating economic news from various world markets. A few key moves were bullish for gold, while others reinforced the bearish streak to end the week without much drastic movement.

Monday began on bullish anticipation that China’s decision to buy two gold-backed exchange-traded products (ETFs) would push up demand for the yellow metal. China was the second largest consumer of gold in 2012 worldwide, so analysts expect this is a good thing for long-term gold prospects, however, we should not expect a huge rally in the near future. China’s ETF buy, rather, provides some stability for the continuation of gold demand.

Also, Standard & Poors upgraded the U.S. credit ranking to stable from previously negative on Monday morning, which boosted the dollar short-term, but did not have a wide effect on gold. China released some raw economic data that was weaker than expected, a subtle bearish factor for the raw commodities.

The Bank of Japan was the big catalyst for Tuesday’s loss, spurring some trading out of the market overnight. The bank decided not to expand its current quantitative easing program, as some had hoped, which pulled gold prices down. However, Bank Governor Haruhiko Kuroda said they might consider it again if their borrowing costs go up.

Wednesday morning was trading in the same ballpark as Tuesday, but saw some gains by the evening. It was a quieter trading day Wednesday, with the “risk-off” mentality making way for some technical short covering later in the day, as a weaker dollar incurred some buying back into gold.

Thursday was a day of speculation, as Japanese stock markets showed some losses and analysts worried whether this would spill over into U.S. trading. Even though gold generally acts as a safe haven during these situations, this week it was carried more heavily by a risk aversion mentality. Currently, economic turmoil is not tense enough to prompt a large shift back into gold.

Friday urged gold a little north as President Obama issued a statement that the U.S. will provide arms to Syrian rebels. This news encouraged traders to think about the possibility of escalation in an already war torn country, which did move some back into the safe haven of gold, ending the week slightly higher than it began.

The marketplace will be anticipating an address from the FOMC next Wednesday.